In 2015, the Chinese pesticide industry was sluggish. All three categories of

pesticide (fungicides, insecticides and herbicides) were affected. Insecticides

experienced a downturn with production and price failing to meet market

expectations.

Production

Insecticide production in 2015 declined from 2014 levels. According to data

from the National Bureau of statistics, between Jan. and Dec., China produced

513,536 tonnes of insecticides (converted into 100% AI) overall, down by 4.3%

YoY, and accounting for 13.72% of the national total chemical pesticide output.

Currently, the market share of insecticide is second only to herbicide.

Exports

In 2015, the Chinese insecticide export market suffered serious setbacks. At

the 3rd Pesticide Import and Export Analysis and Experience Exchange Meeting,

which was held on 10 Dec., Zhang Wenjun, Deputy Director of International

Cooperation Service of the Institute for the Control of Agrochemicals, Ministry

of Agriculture (ICAMA) revealed that:

China's exports of insecticide recorded YoY drops in volume and value

between Jan. and Nov., the largest declines of all categories of pesticide.

Several key insecticide varieties, such as chlorpyrifos, imidacloprid,

acephate, methomyl and lambda-cyhalothrin, all suffered from varying declines

in both the volume and value of exports.

Prices

The prices of insecticides generally continued their downward trend in 2015.

According to price monitoring conducted by CCM, the majority of insecticide prices fell, chlorpyrifos, imidacloprid, acetamiprid, abamectin and emamectin

benzoate being prime examples. Despite this, the price of some insecticide

varieties managed to buck the trend and remain stable, such as cypermethrin TC,

bifenthrin TC, monosultap TC and bisultap TC.

Output of pesticide (converted into 100%

AI) by category in China, 2015

|

Category

|

2015 (tonne)

|

2014 (tonne)

|

YoY change (%)

|

|

Chemical pesticide

|

3,741,082

|

3,657,977

|

2.3

|

|

Insecticide

|

513,536

|

536,372

|

-4.3

|

|

Fungicide

|

182,126

|

198,744

|

-8.4

|

|

Herbicide

|

1,773,997

|

1,801,164

|

-1.5

|

Source: NBS

China’s exports of pesticides by category, Jan.-Nov. 2015

|

Category

|

Export volume (tonne)

|

YoY change (%)

|

Proportion of export volume (%)

|

Export value (million USD)

|

YoY change (%)

|

Proportion of export value (%)

|

|

Herbicide

|

945,300

|

-6.34

|

68.42

|

3,639

|

-20.59

|

54.55

|

|

Insecticide

|

286,500

|

-19.64

|

20.74

|

1,876

|

-21.23

|

28.12

|

|

Fungicide

|

130,400

|

-5.39

|

9.44

|

1,023

|

0.91

|

15.33

|

|

Plant growth regulator

|

18,500

|

8.43

|

1.34

|

129

|

3.84

|

1.94

|

|

Rodenticide

|

800

|

12.31

|

0.06

|

4

|

3.17

|

0.05

|

Source: ICAMA & China Customs

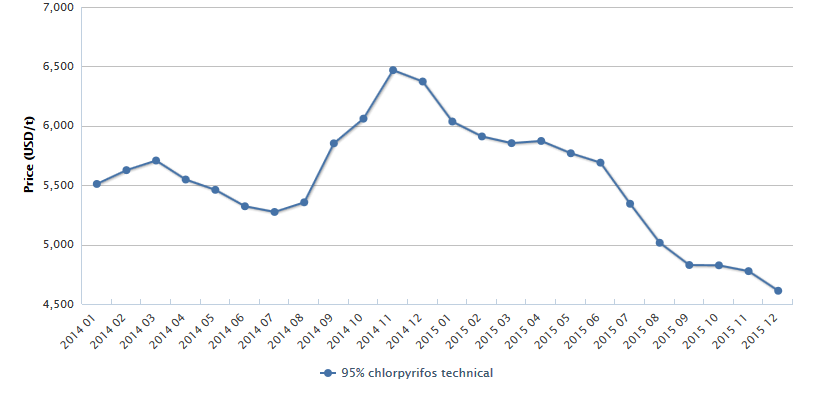

Chlorpyrifos

In 2015, the ex-works price of chlorpyrifos dropped to its lowest ever point.

In Q1, the domestic market was barely active and foreign orders were few.

However, environmental protection and intermediate supply problems reduced the

supply of spot chlorpyrifos, keeping the ex-works price high in spite of a

general downward trend.

In Q2, the ex-works price of chlorpyrifos fell due to weak demand. In addition,

the two major factors which limited supply in Q1 forced some manufacturers to

lower operating rates or even suspend production, causing output to keep

falling.

In Q3, the price of chlorpyrifos continued to fall, decreasing slightly from

Q2. Total market demand for insecticides was slack, and chlorpyrifos was no

exception. Coupled with the effects of the Tianjin explosion and large military

parade in Beijing, output continued to drop.

In Q4, the ex-works price of chlorpyrifos remained low, and took a

further hit before the end of the year. This was due to the presence of

plentiful supplies of chlorpyrifos technical intermediates, which combined with

weak market demand dragged the price to its lowest ever level.

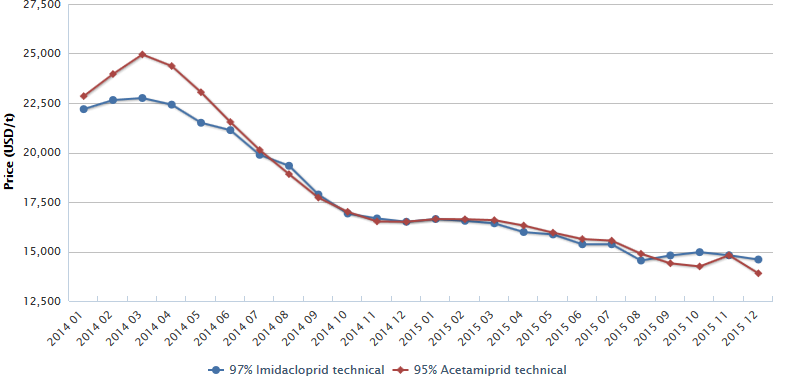

Imidacloprid

In 2015, the imidacloprid technical market slumped. Over the course of H1, its

price kept falling. In H2, its price remained low but stable.

The H1 price drop can be ascribed to the following factors:

-

In

2014, existing technical manufacturers expanded production and new market

entrants boosted overall production, leading to oversupply.

-

From March 2015 onwards, foreign trade orders decreased.

-

Thiamethoxam, which performs well as a seed dressing and is a real

threat to imidacloprid, grabbed part of the market share.

-

In

the first half of 2015, manufacturers operated normally and had relative large

inventories; but demand from the domestic market was scant.

In H2, the price of imidacloprid TC remained stable but low. The reasons for

this being:

-

RMB depreciation slightly increased the value of foreign trade.

-

The price of 2-Chloro-5-chloromethylpyridine, the raw material of

imidacloprid, remained stable and largely unchanged.

-

Under the influence of the Tianjin explosion and the large military

parade in Beijing, some manufacturers in Shandong and Hebei provinces were

forced to suspend production, reducing sport pesticide supply.

Acetamiprid

In 2015, the domestic acetamiprid market was also in the doldrums. The average

annual price was much lower than that in 2014. From March to Dec., the

acetamiprid market was burdened with oversupply, bringing about a decline in

price. Domestic and overseas orders were meager and the export market was

slack. At the end of the year, some manufacturers had large quantities of

stock. Approximate statistics indicate that at end of 2015 stock ranged from

300 tonnes to 400 tonnes.

Monthly ex-works price of 95% chlorpyrifos technical in China, Jan. 2014-Dec.

2015

Source: CCM

Monthly ex-works prices of 97% imidacloprid technical and 95% acetamiprid

technical in China, Jan. 2014-Dec. 2015

Source: CCM

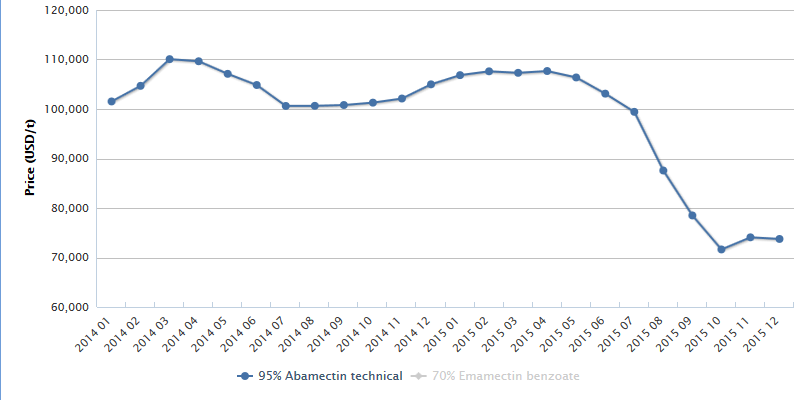

Abamectin

2015 bore witness to a more or less uninterrupted sharp drop in the price of

abamectin.

In Q1, the market price of abamectin remained stable, equal to its 2014 level.

At the end of Jan., slightly squeezed supply edged the price up.

In Q2, prices started to fall. Export orders decreased from the end of March onwards.

Tight supply from Q1 was eased and together with slack domestic demand, supply

and demand were balanced. In May, Shijiazhuang Xingbai Bio-engineering Co.,

Ltd. opted to suspend production because of slack demand.

In Q3, market demand for abamectin was still weak and the market price of

abamectin continued to fall. By the end of Sept., the total stock of domestic

manufacturers was nearly 200 tonnes. Since this product dissolves easily and

cannot be stored for a long period of time, manufacturers were pressurized to offer

cut-price promotions. In addition, some enterprises illegally produced

abamectin without a production license, disrupting the product's market price.

In Q4, demand for abamectin was still weak. Despite this, its price remained

stable and low, after the abamectin working group of the China Crop Protection

Industry Association reported illegal unlicensed production to relevant

departments.

Emamectin benzoate

In the first half of 2015, the emamectin benzoate market trended downwards.

It’s worth noting that its price followed the uptrend of the abamectin price in

Q3.

Following March, the supply of spot abamectin was sufficient enough to support the

supply of emamectin benzoate. However, foreign orders were few and domestic

demand decreased, doing nothing to abate the drop in price.

In Q3, with weak demand for emamectin benzoate and the decreasing price of

abamectin, the downward trend in the price of emamectin benzoate continued.

In Q4, emamectin benzoate followed suit of abamectin price. As the abamectin

price remained stable and low, so did the emamectin benzoate price.

Monthly ex-works prices of 95% abamectin

technical and 70% emamectin benzoate technical in China, Jan. 2014-Dec. 2015

Source: CCM

About CCM:

CCM is the leading market intelligence provider for

China’s agriculture, chemicals, food & ingredients and life science

markets. Founded in 2001, CCM offers a range of data and content solutions,

from price and trade data to industry newsletters and customized market

research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta.

CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: pesticide, insecticide, chlorpyrifos, imidacloprid, acetamiprid, Abamectin, Emamectin benzoate